Thesis:

Bitcoin mining can be an industrial resource for industrial plants to offset their Peak Demand charges on their electric bills. Peak Demand charges can account for 30-70% of an industrial plant’s bill. Peak Demand charges are determined by the maximum amount of energy consumption in a given 15 minute duration. These plants do not demand this maximum amount of consumption during a 24 hour period, meaning they can turn on additional equipment without incurring more Peak Demand fees. Bitcoin miners could be this equipment to offset Peak Demand fees.

Industrial Plants - American Manufacturing

I'm not an electrician or engineer. But I'm pro-bitcoin and consider bitcoin mining to be its greatest utility.

I’ve spent the past 8 years of my career as a contractor working in industrial manufacturing plants. I’ve been in food manufacturing plants, pharmaceutical manufacturing plants, waste processing plants, corrugation packaging manufacturing plants, and many more. Everyone of these plants operates the same business model - anticipate future demand from previous years, and create enough of their commodities to fulfill that anticipated demand.

This production cycle creates a very volatile energy-consumption profile for every plant. Imagine a food manufacturing plant with 6 production lines to fulfill their different products. Sometimes, this food plant will need to run at maximum capacity (all 6 lines) to fulfill holiday demand. After the holiday, some of those production lines can sit idle while maintenance contractors (my experience) inspect the equipment and building during these scheduled shut downs.

Here’s the kicker for their electric bill - whether this food production plant is running all 6 lines, or only 3 lines, they are still getting billed for the same Peak Demand costs. WTF? WTF indeed if you’re first learning about industrial power consumption. But it actually makes sense from the electric company’s perspective.

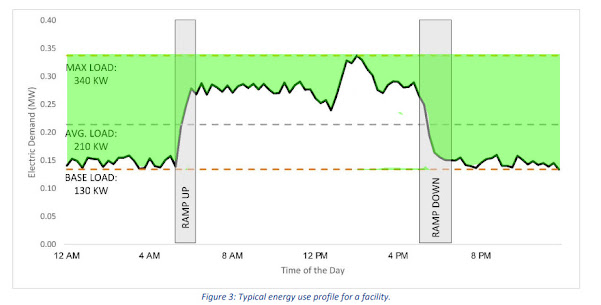

Here’s a graph of a typical/theoretical industrial facility from the Department of Energy (pg. 8)

What you see are 3 load types: base load, avg load, and Max Load. Max load is how we determine a plant's Peak Demand Costs. This particular plant has a max load at 340 KW. This means that in order for the utility provider to properly serve this industrial manufacturing plant the necessary amount of electricity to operate, it needs to offer a capacity of 340 KW of power at any given moment. This means the utility company needs to have 340 KW of equipment and infrastructure and energy on standby, just for this moment, which is why this cost is a large part of this plant’s energy bill.

But let’s take a closer look. Only for about 15 minutes does this plant actually need 340 KW of capacity. The areas highlighted in green in the same graph below, shows all of the demand capacity this plant is getting invoiced for. But they aren’t using the capacity! They’re leaving power capacity on the table that they could be using to produce and manufacture some other commodity. The gap in capacity usage is so large, that there’s 10 straight hours (7PM - 5AM) of 200 KW not being utilized.

How can an industrial plant offset these peak demand charges? Bitcoin mining? Maybe…

Every manufacturing plant does the same thing: convert electricity into a commodity. And that’s no different than bitcoin mining. So can these industrial manufacturing facilities, who already have electrical engineers and system controllers, use this excess, unused capacity to mine bitcoin to help offset these Peak Demand charges?

Maybe…

Every industrial & commercial facility gets invoiced for both Peak Demand (measured in KW), and Energy Consumption (measured in KWh). As residential energy consumers, we’re more than familiar with the energy consumption portion (KWh). This typically costs us $0.10 per KWh, give or take, depending where we live. But residential people don’t get charged for the Peak Demand. Only commercial and industrial facilities get charged for this. And Peak Demand can cost anywhere between $5 to $50 per KW, or even more. Here is a geographical chart created by the National Renewable Energy lab in 2017

So for the theoretical plant above, if 340 KW is their Peak Demand, and their peak demand is $15 per KW, they’re getting charged for 340 KW x $15 = $5100 per month IN ADDITION TO THE ENERGY CONSUMPTION (KWh).

So, to find out if it’s worth a facility to crank up extra equipment to max out that capacity, we have to know if the value produced by that extra equipment (bitcoin) is greater than the additional cost of energy consumption (KWh). This really is no different than any other bitcoin mining operation. The key difference is that industrial plants may be able to take advantage of lower KWh rates, as long as their extra consumption doesn’t raise the Peak Demand.

Let’s look at some numbers…

In April 2022, the avg KWh price for an industrial plant in Pennsylvania is $0.0754.

Let’s say the KW cost for Peak Demand in this whatever area in Pennsylvania is $15 per KW.

This means the total monthly bill for this plant is:

210 KW avg x 24 hrs x 30 days x $0.0754 = $11,400

340 KW Peak Demand x $15 = $5,100

Total = $16,500

Now, let's see what happens when we add some bitcoin miners into this mix. The goal is that we’re utilizing the capacity that we’re already being invoiced for, to produce additional commodities.

Let’s work with Antminer S19 Pro. This has a wattage of 3250. Looking at the chart, let’s assume we can run these for 10 hrs every day. That means:

(3250 W x 10 Hrs per day) / 1000 = 32.5 KWh

So 1 Antminer will consume 32.5 KWh per day. This is important to know, since we have about 200 KW of wiggle room between our base load and Peak Demand (because we don’t want to increase our Peak Demand with bitcoin miners). So let’s assume our fictitious plant runs 6 Antminer S19 Pro’s for 10 hrs per day for 30 days:

32.5 KWh x 6 miners x 30 days = 5,850 KWh per month consumption

So our new invoice, if running 6 Antminer S19 Pro’s for 10 hrs per day for 1 month would be:

210 KW avg x 24 hrs x 30 days x $0.0754 = $11,400

340 KW Peak Demand x $15 = $5100

32.5 KWh x 6 miners x 30 days x $0.0754 = $441

Total = $16,941

Now, how profitable was our bitcoin mining? According to this mining calculator, our S19’s will make $8.31 per day (as of 7-7-2022). If we’re running for 10 hrs per day, that’s about 42% of the day. So $8.31 x 0.42 = $3.50 per day

$3.50 per day x 30 days x 6 miners = $628

Meh, not too amazing, but it would offset the cost by almost $200.

Although our energy cost to operate our day to day business, plus the cost to run 6 miners for 10 hrs per day is more expensive, we’re earning a new commodity that is worth more than the additional cost of energy consumption. Which will help offset the Peak Demand charges.

Of course, this isn’t accounting for the cost for the ASIC miners. But, commercial and industrial plants are already setting aside defense budgets to mitigate the growing Peak Demand rates. Which is why so many plants are looking into battery & solar combos, which is significantly more expensive than bitcoin miners.

Let’s check out another example. How about a brewery based in Pennsylvania?

Let’s use this load profile from a brewery in California, and just use Pennsylvania rates. Ironically, this chart came from a battery/solar company that’s trying to offset peak demand charges with batteries. But when looking at the chart, just pay attention to the choppy line, which is where we are getting our KWh and KW numbers.

Based on the chart, this brewery appears to have a daily energy consumption of about 14,720 KWh. And, it appears this brewery has a peak demand cost of just under 1100 KW. So, this brewery’s monthly bill would break out to be:

14,720 x 30 days x $0.0754 = $32,297

1100 KW x $15 = $16,500

Total = $48,797

Looking at the chart, and seeing where we can juice that demand capacity, let’s assume we can run 12 S19 Pros for 12 hrs per day. Here’s what we get when we add bitcoin mining to our energy mix:

Additional consumption

(12) S19 Pro for 12 hrs per day = 14,040 KWh x $0.0754 = $1,059

Bitcoin profitability

$4.15 per day x 30 days x 12 miners = $1,494

So, if this brewery decided to run (12) S19 Pro antminers for 12 hrs per day, they would add $1,026 to their consumption fees. BUT they would net 0.0726 BTC @ $21,000/BTC = $1,524.

Observations

Based on this crude, digital-napkin mathamentals, it appears that it is worth industrial and commercial facilities to at least think about running bitcoin miners. Certainly, the industrial facility needs to have the right energy load profile. And, the KW rates have to be high enough, with KWh rates low enough for it to make sense. If you run these scenarios with plants in California, it usually doesn’t make sense. But it we run these scenarios in places like Georgia, it appears to make a whole lot of sense. Because Georgia has low KWh consumption rates (comparable to Pennsylvania), but high Peak Demand rates (many locations exceeding $25).

Additionally, we have to be mindful of the variables. Obviously with bitcoin tanking in price, the profitability won’t be great. But considering the excellent KWh rates commercial and industrial facilities get, bitcoin mining should be in the discussion for how plants can offset their overhead costs.

External Ramifications and pie-in-the-sky thoughts

If industries start to mine bitcoin as supplemental income/commodity production, this can help subsidize manufacturing, and onshore more manufacturing back into America (as James McGinniss quasi talks about in his post)

If industries start to mine bitcoin, this strengthens the bitcoin network’s decentralization.

If industrial manufacturers start to mine bitcoin, they won’t be under the same pressure to sell bitcoin as pure mining companies, because it won’t be their core business. They could end up being industrial/corporate hodlers.

If industrial manufacturers start to hodl bitcoin, they could end up using bitcoin reserves to trade with other manufacturers, filling up bitcoin block space, and transaction fees.

This isn’t a free lunch, however. The plants will need to buy the miners and put up capital (the glory of PoW).

If these plants sign up for Demand-Response programs, they can earn additional cash when prompted to turn off their miners.